The following has been developed to provide a broad analysis of the House Transportation & Infrastructure Committee’s 5-year transportation reauthorization legislation. The summary below is intended to be a broad summary. Additional analysis and State by State breakdowns is forthcoming.

On June 18, 2020, the House Transportation & Infrastructure Committee (T&I) cleared a five-year, $494 billion surface transportation reauthorization bill—the “Investing in a New Vision for the Environment and Surface Transportation in America (INVEST) Act. The bill proposes to increase surface transportation investment by 62 percent above current spending levels. The bill would also weave in climate change and resiliency into the core federal transportation program.

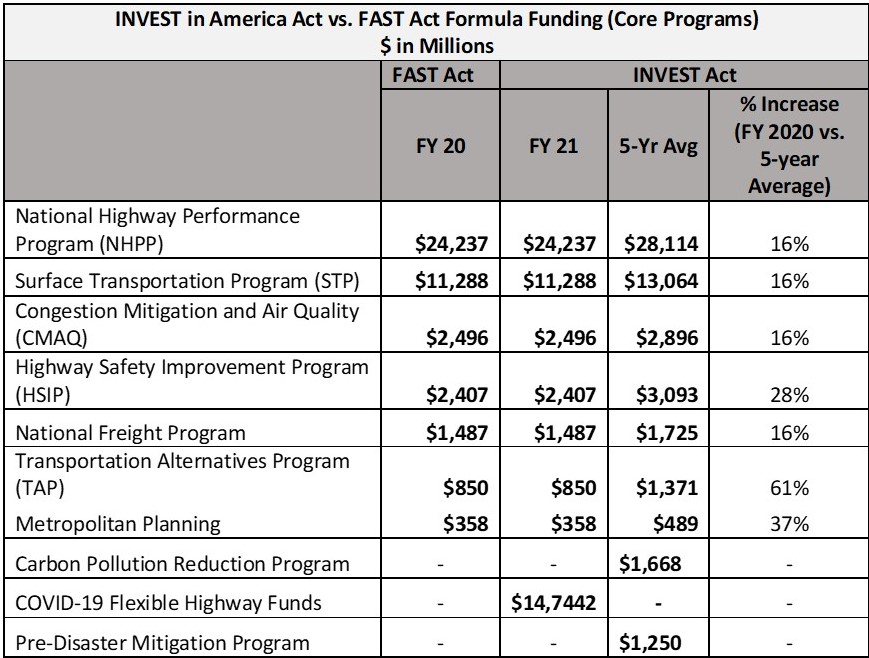

Of the $424 billion in proposed highway and transit resources, approximately 75 percent would be directed to the core programs (compared to 90 percent in the Senate). Congress would need to identify an estimated $140 billion on top of anticipated Highway Trust Fund (HTF) revenues to fund the INVEST in America Act. To put that figure in perspective, Congress would have to nearly double the gas tax to fund this bill from gas tax receipts only.

Below are some notable highlights in the legislation:

New Funding Programs & Policies do Not Start Until 2022

Very few of the policy and programmatic changes in the INVEST Act would take place in FY 2021. Instead, the legislation provides funding increases and flexibility for states, regions, and transit operators in FY 2021 to address COVID-19 related issues.

Highway Title

Changes to Core Programs:

National Highway Performance Program

- Restricts use of funding for capacity unless road is up to a State of Good Repair and a Cost Benefit Analysis has been done to show value in new capacity over Operation Improvements

- Requires States to spend 20 percent of their NHPP and Surface Transportation Program (STP) any area dollars on bridge repair and rehabilitation projects, supporting approximately $28 billion in fix-it-first bridge investments in FY 2022-2025

Surface Transportation Program (STP)

- Increases STP Local Sub-allocation requirements from 55% in FY 20 escalating to 60% in FY 25

- Creates set-aside for communities of all sizes

- Increases the Transportation Alternatives Program by 60%

Congestion Mitigation Air Quality Program (CMAQ)

- Allows operating expenses beyond 3-year limit

Performance Measures

- Creates new access performance measure

- Creates new climate change performance measure based on carbon emission reductions

- Does not allow States to set regressive safety targets

Tolling/Pricing

- Reestablishes the requirement that FHWA enter into a toll agreement before allowing tolling on a Federal-aid highway.

- Establishes additional guardrails around tolling to ensure that any adverse impacts both on and off the facility are evaluated and addressed. Authorizes congestion pricing with the additional guardrails.

- Allows, under conditions, regions to convert roads to congestion priced facilities. FHWA must approve and has 60 days to approve such application.

New Programs

New Annual Formula Programs

- Carbon Pollution Reduction Program

Includes a new apportioned program ($8.35b for FY22-25) to support carbon pollution reduction. Gives States broad eligibility to invest in highway, transit, and rail projects, as well as support operating costs, and holds States accountable by measuring their annual progress. Provides benefits for States that make the most progress and requires low-performing States to invest 10 percent of their STP any area funds in additional projects to help reduce carbon pollution.

- Pre-Disaster Mitigation Program

Creates a new apportioned program ($6.25b for FY22-25) to fund resilience and emergency evacuation needs. Requires States and metropolitan planning organizations (MPOs) to develop an infrastructure vulnerability assessment to guide investments under the program. Makes resilience a core part of the Federal-aid highway program

New Annual Discretionary Programs

- Projects of National and Regional Significance. The bill would replace the existing Infrastructure for Rebuilding America (INFRA) discretionary grant freight program with the Projects of National and Regional Significance (PNRS) program Provides more than $9 billion over the life of the bill for large highway, transit, and freight projects that cannot be funded through annual apportionments or other discretionary sources. In general, PNRS grant eligibility would be limited to projects costing $100 million or greater; the minimum grant size would be $25 million. With respect to public transit and freight projects, the projects would be eligible only insofar as they also provide a benefit to public roads or the national highway system, respectively. Of note, the bill would guarantee funding for the PNRS program by funding the grants out of the HTF rather than the General Fund.

- Community Transportation Investment Grants. Provides $600 million per year for local government applicants. Includes broad eligibility for highway and transit projects, with project evaluation done in a manner that will limit political decision-making.

- Electric Vehicle Charging and Hydrogen Fueling Infrastructure Grants. Provides $350 million per year for grants for electric vehicle charging and hydrogen fueling infrastructure. Focuses funding on designated Alternative Fuel Corridors and projects that demonstrate the most effective emissions reductions.

- Community Climate Innovation Grants. Provides $250 million per year to non-State applicants for highway, transit, and rail projects, provided they reduce GHGs.

- Metro Performance Program. Provides a total of $750 million over the life of the bill for funding allocations directly to MPOs to carry out projects selected by the MPO. The Secretary selects applicants to be accepted into the program based on their technical capacity to manage Federal funds.

New One-Year Discretionary Programs

- Gridlock Reduction Grants. Provides $250 million, of which half is set aside for freight grants. Grants will be awarded for reducing urban congestion in large metro areas, with an emphasis on operational, technological, and mode shift strategies.

- Rebuild Rural Grants. Provides $250 million for rural communities to address needs on and off the Federal-aid system. Focuses funding on safety, state of good repair, and access to jobs and services.

- Active Transportation Connectivity Grants. Provides $250 million for pedestrian and bicycle networks and spines and related planning, including complete streets planning.

- Commercial Motor Vehicle Parking Grants. Provides $250 million to construct and improve truck parking facilities.

Transit Title

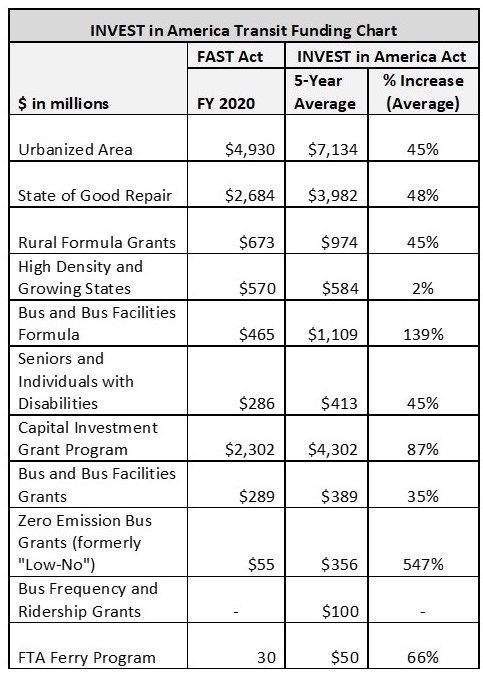

The INVEST Act would significantly increase public transportation funding, growing federal transit investment by 72 percent compared to a 42 percent growth in the highway program.

Among the notable changes the legislation places a focus on High Frequency Bus Service, below are some of the provisions included:

Programmatic and Funding Changes:

- Modifies the urban and bus formulas to incentivize frequent rail and bus service – eliminates existing incentive tier

- Provides $100 million in annual grants to tackle larger city street congestion that slows down buses through support of items like bus only lanes and priority signaling. The program is structured to require a partnership between transit agencies and local/State roadway agencies.

- Increases bus funding by 150 percent to reverse the MAP-21 bus cuts.

- Narrows the competitive bus grants to focus on bus facilities and fleet expansions.

- Increases zero emission bus competitive grants fivefold.

- Creates a new state of good repair formula subgrant to push additional formula dollars to transit agencies with the oldest buses.

- The bill would create a new affordable housing incentive in the Capital Investment Grant program, directing FTA to boost an applicant’s rating “if the applicant demonstrates substantial efforts to preserve or encourage affordable housing near the project.”

Limits Innovation – Protects Workforce

- Limits ability of agencies to use FTA funds for MoD or A/V

- Requires agencies that utilize those services to develop jobs report/workforce plan

- Does allow agencies to use Federal funds for Mobility as a System, but language is restrictive and confusing

Planning

In addition to the numerous performance measure changes, the bill also adds new State and regional planning requirements, including adding climate change and a vulnerability assessment as new categories of the regional transportation plan and a requirement to list resilience projects as a new category in the four-year transportation investment strategy (Transportation Improvement Program, or TIP). With regards to the long-range climate planning requirements, the bill requires States and MPOs to identify investments and strategies to reduce per-capita greenhouse gas emissions from transportation sources, identify investments and strategies to manage transportation demand and increase the non-single occupancy vehicle mode share, and “recommend zoning and other land use policies that would support infill, transit-oriented development and mixed use development.”

The long-range plan vulnerability assessment would be required to include a critical infrastructure risk-assessment, analysis of evacuation routes, and a description of the MPO’s adaptation and resilience improvement strategies that will inform the region’s transportation investment decisions.

The bill further requires States and MPOs to incorporate an equity-focused “transportation access” assessment into the TIP. The bill would direct USDOT to develop a dataset states and MPOs would use to assess the level of safe, reliable, and convenient access to jobs and services by mode. States and MPOs would be required to incorporate into TIPs a description of how the investment strategy would improve the overall level of system access, similar to the existing requirement that TIPs include a description of how the planned investment strategy would make progress toward a region’s performance targets.

Research

- Increases funding for UTCs

- Increases, renames, and reforms ATCMTD program

- $70 million/year

- Increases match from 50% Federal to 80% Federal

- Creates small open-ended research program

- Establishes a new Highly Automated Vehicle and Mobility Innovation Clearinghouse to study the societal impacts of automated vehicles and Mobility on Demand.

- Authorizes automated vehicle research on improving safety for all road users and expanding accessibility in an equitable manner.

- Authorizes new FTA research to enhance transit worker safety and expand Mobility on Demand

- Creates a new Vehicle-Miles Traveled (VMT) Pilots

- Nearly doubles funding for VMT pilots across the country, encouraging States to begin implementing successful VMT programs.

- Establishes a national VMT pilot program, including both passenger and commercial vehicles in all 50 States, to invest in developing a sustainable funding mechanism for the surface transportation system.

Rail

The House INVEST Act also included significant new funding for rail, investing $60 billion over the next five years. Specifically, the bill triples funding for Amtrak to $29 billion, which includes improvements to and expansion of the passenger rail network, as well as funding to modernize Amtrak’s equipment, stations and facilities. This funding will be particularly important to the Northeast Corridor, which requires substantial capital funding to address a backlog of projects. The bill also considerably increases funding to $7 billion for the Consolidated Rail Infrastructure and Safety Improvements (CRISI) program, which was created in the FAST Act to fund a broad swath of passenger and freight rail programs. Importantly for many commuter rail systems, the program eligibilities are expanded to allow commuter rail to compete for the funds. The bill also creates a new $19 billion grant program devoted to passenger rail improvements and expansion, including high-speed rail. Finally, several highway trust fund programs, like the new Projects of National and Regional Significance, make passenger and freight rail eligible to compete for funding.

Notably, the bill also addresses several freight rail issues, particularly those that impact communities. The bill creates a new $2.5 billion grade separation grant program. It also addresses the issues of longer trains, which block grade crossings and impact local traffic and emergency response times. Finally, the bill prohibits the Department of Transportation from allowing the transport of liquified national gas by rail tank car until additional safety analysis is performed.