As the pandemic’s economic crisis takes a toll across the country and while additional federal support remains unknown at this time, states are contending with major tax and revenue implications affecting their budgets. State officials are all pushing for Congress and the Administration to approve additional aid for state and local governments. Governor Cuomo and Governor Hogan Call on Congress to Pass $500 Billion State Stabilization Fund in Next COVID-19 Relief Package.

Without federal aid, revenue projections for the states are bleak.

On July 29, Governors Larry Hogan of Maryland, the National Governors Association chair, and Andrew Cuomo of New York, the NGA vice chair, issued this statement.

Meanwhile, the latest news from the Bureau of Economic Analysis (BEA) revealed the US Gross Domestic Product (GDP) dropped 32.9% in the second quarter of 2020 – the worst on record. The BEA reports that the GDP in New England dropped 5.2% in the first quarter of 2020, while New York State dropped 8.2%. Second quarter analysis for the states will be published in early October. And to make matters worse, unemployment claims are starting to rise again.

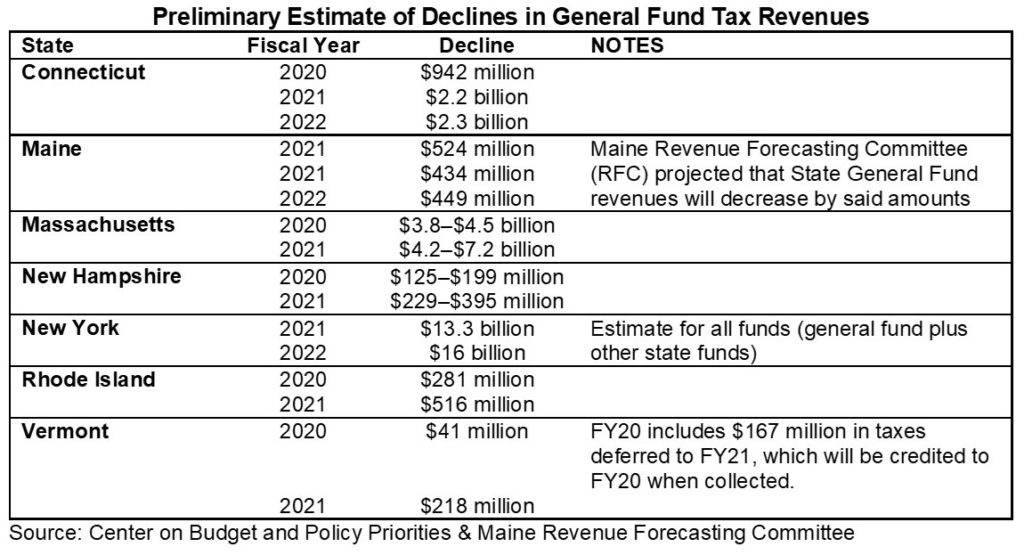

According to the Institute on Taxation and Economic Policy, here is a quick rundown on their revenue projections for some of the Northeast states:

- MAINE forecasters anticipate a $1.5 billion revenue shortfall for the state over the next three years, with a $523 million drop in revenue expected during the current fiscal year.

- The MASSACHUSETTS House passed an economic growth bill that includes sports betting. The bill would require license holders to pay a 15 percent excise tax, or “privilege tax,” of the operator’s adjusted gross sports waging receipts. The bill also includes a one percent fee on sports bets placed within state facilities. The bill is expected to face scrutiny in the Senate.

- NEW HAMPSHIRE state revenues for FY20 are projected to be $142.5 million below the initial revenue plan, or 6 percent of the total general and education fund. If the shortfall ends up being $157.6 million or higher, the shortfall will trigger an increase in business taxes. The Hospital Association stated that hospitals have lost more than $530 million in revenue since March, and that they need additional state funds to cover the shortfall. Gov. Chris Sununu announced that $25 million in CARES Act funding will be allocated to eight hospitals.

Please see additional stories regarding state funding below.

Connecticut

Comptroller letter to the governor reflecting financial statements for the General Fund and the Transportation Fund through May 31, 2020

Maine

Governor Mills Statement on Revenue Forecasting Committee Projections

Massachusetts

Citing COVID-19, the Massachusetts Legislature looks to extend formal sessions past July 31 (MassLive)

Massachusetts tax revenue in June down 21.7% compared to last year, according to interim report (MassLive)

New Hampshire

Coronavirus Pandemic Continues To Haunt State Revenues (InDepthNH)

New York

Governor Cuomo said a federal proposal to let people pay income taxes where they live if they work from home could devastate the city’s finances, adding to concerns about the state’s financial picture.

New York’s June tax receipts dropped by $1.5 billion compared to last year (New York Post)

New York’s tax revenues will fall by $13 billion in 2021 and by $16 billion in 2022, according to the state’s Division of Budget. (Wall Street Journal)

Rhode Island

Boston Fed sees R.I. Q2 tax revenue drop of at least $287M (Providence Business News)

Vermont

Vermont sees unexpected revenue boost after July tax filings (VT Digger)